Abstract

A letter of credit(LC) is also named a documentary credit(DC) in globalized international trade. In recent times, banks utilize blockchain technology regarding the formulation of letters of credit . The ICC regulates market practices (Documentary Credit 600). These include the advising bank that will give the documentary credit to the beneficiary or their nominated bank and provide their nominated bank with any amendments to the letter of credit. The bank retains a certain percentage of the letter of credit value for security. Blockchain technology is available for the letter of credit procedure and trade finance is related to it. Commerce and international trade finance include products such as issuing letters of credit, indemnifying Bills of Lading, etc. Although the letter of credit was created in the old world, methods managing the shipping of goods and related accommodations. But there is a great potential to supersede these paper processes with digitized operations utilizing blockchain technology. International trade requires a number of participants to interact with one another, i.e., the exporters, importers, banks, shipping companies, port-related entities, and customs. Trade finance in supply chain management(SCM) includes products such as lending, issuing letters of credit, factoring, export credit, and indemnification. Therefore, we can say that letter of credit and blockchain technology both are used in A Supply Chain for running international trade safely.

Keywords: Letter of credit and blockchain technology.

Introduction

Documentary credit is nothing but an instrument that helps globalized international trade. Sometimes it is used in the same country between different entities also. It entails a payment mechanism. A letter of credit is categorized in financial law as a form of a simple document that guarantees derivatives and insurance. It allocates risk from one party to another. In recent times banks regarding the formulation of letters of credit used blockchain technology. The emergence of integrative trade and global value chains over the past 20 years has changed the competitive landscape in international goods and services markets. They have worked hard with their logistic partners to reduce costs, accelerate delivery times, better manage risks and automate information flows. As a result, the management of materials and final goods takes place efficiently today, which allows companies to collect with relative ease from suppliers that are at multiple and distant markets. They have wrought strenuously with their logistics partners to reduce costs, expedite distribution times, better manage risks and automate information flows. This article aims to discuss various issues of a letter of credit and blochchain technology that helps the supply chain as a tool.

Documentary Credit

The Uniform Customs and Practice for Documentary Credits 600 (1997 Revision) regulates mundane market practices within the letter of credit-related areas. So that terms are cognate to letters of credit that categorize the sundry actors within a transaction. These are crucial to understanding the role financial institutions play. These include the advising bank is the bank which will apprise the beneficiary or their nominated bank, and provide the beneficiary or their nominated bank with any amendments to the letter of credit. To make a letter of credit first, it is required to have an updated trade license. Audit report, Import registration certificate, Chamber House membership, Income tax certificate, Vat registration, etc. are required. Before submission of these certificates to the bank need to have an LC application form, insurance cover note, etc. The account holder’s bank will check all the documents and confirm within a few days. Need to have a certain percentage of the Letter of credit value to the bank. Sometimes letter of credit and blockchain technology both are used in international trade.

Blockchain can help

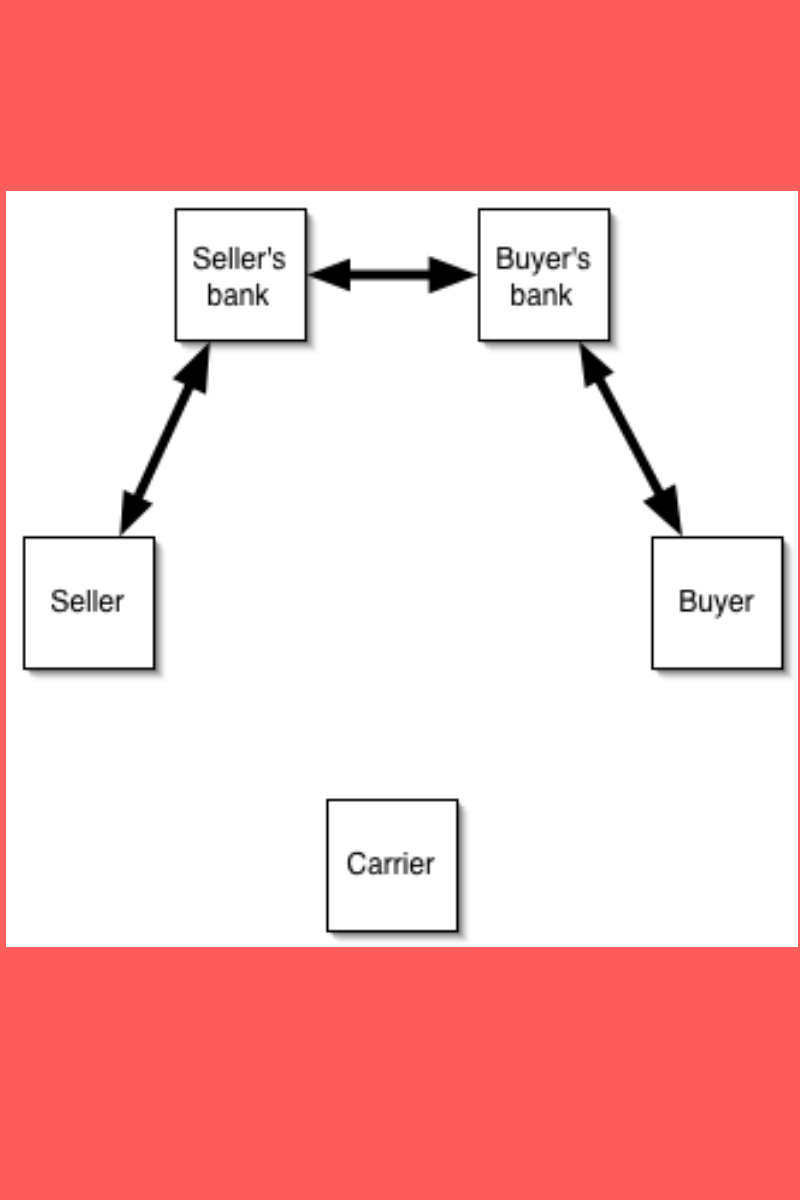

Blockchain and letter of credit trade finance relate to the process of certain financing activities in areas of commerce and international trade. Financing includes products such as lending and issuing letters of credit, factoring export credit, and indemnification of bills of lading which are old-world methods of managing the shipping of goods and accommodations. There is a potential to supersede these paper processes with digitized operations that utilize blockchain technology. Conducting international trade requires a number of participants to interact with each other such as exporters, banks, shipping companies, port-related entities, and customs.

Reduced fraud

A letter of credit usually involves some manual procedures and a possibility of documentary fraud exists. So that the process can be ineffective and extravagant. We can overcome these challenges by utilizing letter of credit and blockchain technology simultaneously. In a blockchain, if we consider a typical international trade, we can see that the exporter, custom importer indemnification and importer bank each of them has representative nodes connected to a private blockchain which replicates transformation information as it occurs on the network at a given point and time the information ledger across all nodes is in sync.

Submission of docs

In blockchain, there is a genuine solution to initiate the contract. The exporter uploads the indispensable documents such as letters of credit, bills of lading, and indemnification documents from the decentralized application. The exporter then submits the contract on the blockchain. Once the exporter submits the contract, we can send a transaction to the blockchain. Transactions remain pending until the mining is consummated. A miner mines the transaction and integrates it to the blockchain. Once the transaction is prosperously integrated into the blockchain, a unique address is engendered where information is stored on the ledger. This engenders a unique tamper-proof contract engendered by the exporter. The customs authenticate onto the decentralized application. After verifying the relative documents, the customs officer approves the contract. The customs fee is processed on the blockchain. Importer authenticates into the decentralized application in case the goods are damaged, that is the scenario here. The importer uploads the indemnification documents and proof of damage on the blockchain insurer authenticated into the decentralized application. The insurer checks the indemnification documents and proof of damaged goods.

New trends in contract management

A letter of credit is a very streamlined concept to manage contracts. As it’s clear with these trends, the future of contract management looks to be more automated, visibility, streamlined, and efficient than ever before which can only spell positive changes in the Industry. Blockchain management can take a hold of contract management also. Whether it’s with the use of smart contracts that allow all parties full anonymity or the cloud housing all of our important documents for a more streamlined process. There’s no telling where the next step will take us in contract management.

HSBC’s experience in Bangladesh in this area

Md Mahbub-ur Rahman, CEO of HSBC Bangladesh, informs that this will usher in a new era of routing international trade transactions as businesses and governments recognize transparency, security, and swiftness in performing tasks using blockchain technology. The digitized letter of credit (LC) transaction brought a notable reduction in the processing time compared to traditional methods – down from an average of five to 10 days to under 24 hours. The Bangladesh arm of HSBC, one of the world’s largest banks, has completed the country’s first cross-border blockchain trade finance transaction.

Conclusion

From the above discussion, it is almost clear that a letter of credit is an inevitable tool of business. But when we use letters of credit in the old way, it is sometimes open to fraud and less dependable. Blockchain technology can help us in this regard to make this tool of business and supply chain more dependable. HSBC and some other international banks already started to use this technology in handling documentary credit. It is a piece of good news for the international business community and supply chain managers also.

References:

1. Lamourex,J-F.,& Evans,T.(2011).Supply Chain Finance: A new means to support the Competitiveness and Resilience of Global Value Chains.SSRN Electronic Journal,289-

2. https://doi.org/10.2139/ssrn.2179944

3. He,X.,& Tang,L.(2012).Exploration on Building of of Visualization Platform to Innovate Business Operation Patterns of Supply Chain Finance.Physics Procedia,33,1886-1893. https://doi.org/10.1016/j.phpro.2012.05.298

4. Sebastian, Sinclair.(2020).”Story from News HSBC Carries Out Bangladesh’s First Blockchain Letter-of-Credit Transaction”.https://www.coindesk.com/hsbc-carries-out-bangladeshs-first-blockchain-letter-of-credit-transaction/

5. https://youtu.be/gBpogDsCvlM

6. https://rumble.com/v304wmy-does-blockchain-revolutionize-supply-chains-uncovering-the-answer-with-lett.html